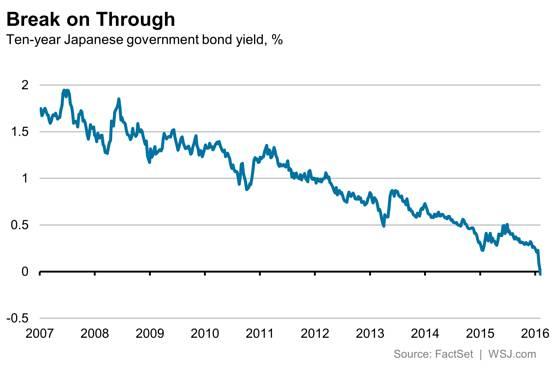

Japan’s government bond yields have surged to their highest level in 16 years amid increasing speculation about potential interest rate hikes. This significant rise reflects growing investor expectations that the Bank of Japan may soon begin tightening its long-standing ultra-loose monetary policy. As global central banks ramp up rates to combat inflation, Japan’s bond market is signaling a possible shift in the country’s accommodative stance, raising questions about the economic outlook and the future of its financial markets.

Japan’s Bond Yields Surge to 16 Year Peak Amid Rising Rate Hike Expectations

Japan’s government bond yields have climbed to levels unseen since 2008, fueled by intensified speculation around possible shifts in the Bank of Japan’s ultra-loose monetary policy. Investors are increasingly pricing in the likelihood of interest rate hikes as inflation pressures mount and global central banks continue their tightening cycles. The 10-year bond yield recently breached the 0.5% mark, shaking off years of near-zero and negative yields that have characterized Japan’s bond market.

Key factors driving the surge include:

- Rising global inflation pushing policymakers toward monetary normalization

- Stronger-than-expected economic data signaling robust recovery momentum

- Market repositioning ahead of upcoming Bank of Japan policy meetings

| Bond Maturity | Yield (Current) | Yield (1 Month Ago) |

|---|---|---|

| 2-Year JGB | 0.12% | 0.05% |

| 5-Year JGB | 0.31% | 0.23% |

| 10-Year JGB | 0.51% | 0.42% |

Bank of Japan Faces Intensified Pressure to Adjust Monetary Policy

The recent surge in Japanese government bond yields, touching a 16-year peak, has sent shockwaves through both domestic and international financial spheres. Investors are increasingly speculating that the Bank of Japan’s long-held ultra-loose monetary stance may soon face significant revisions. As inflationary pressures rise and global central banks continue tightening policies, voices demanding a recalibration of Japan’s approach have grown louder, signaling a pivotal moment for the world’s third-largest economy.

Key factors fuelling the debate include:

- Rising global interest rates pushing up borrowing costs and affecting capital flows.

- Persistent inflation exceeding the Bank of Japan’s 2% target, eroding real yields.

- Stronger yen dynamics impacting export competitiveness.

| Indicator | Current Value | 6-Month Change |

|---|---|---|

| 10-Year JGB Yield | 0.45% | +0.15% |

| Core Inflation Rate | 3.1% | +0.7% |

| Yen/USD Exchange Rate | 134.7 | -5.2% |

Investment Strategies for Navigating Japan’s Shifting Yield Landscape

Amidst Japan’s bond yields reaching a 16-year peak, investors are recalibrating their approaches to manage rising interest rate risks and capitalize on new opportunities. Fixed income investors should consider diversifying across different maturities to balance yield enhancement with duration risk. Shorter-duration bonds offer protection against price volatility as yields climb, while selective exposure to longer-dated issues can capture incremental income once the curve stabilizes. Additionally, incorporating inflation-linked securities provides a hedge against unexpected inflationary pressures, which may accompany the evolving monetary policy stance.

Strategic actions in the current environment include:

- Increasing allocation to variable-rate instruments to benefit from potential rate increases

- Exploring international bond markets to diversify country-specific monetary impacts

- Utilizing bond ETFs for tactical shifts in yield curve positioning with greater liquidity

- Considering credit quality adjustments, favouring higher-grade issuers amid tightening conditions

| Strategy | Benefit | Risk Mitigation |

|---|---|---|

| Short Duration Bonds | Lower interest rate sensitivity | Reduced price volatility |

| Inflation-Linked Securities | Protection vs. real rate changes | Hedge against inflation surprises |

| Variable-Rate Notes | Income rises with rates | Mitigate fixed coupon lock-in |

| International Bonds | Diversification benefits | Currency and geopolitical risks |

Wrapping Up

As Japan’s bond yields reach levels not seen in 16 years, market participants are closely monitoring the implications for the country’s economic outlook and monetary policy. With growing speculation about potential rate hikes, investors and policymakers alike face a pivotal moment in assessing the future trajectory of Japan’s financial landscape. The developments underscore a significant shift in market sentiment, signaling that the era of prolonged ultra-loose monetary policy may be entering a new phase.